I am seriously thinking about getting a Mazda5 pretty soon, but have one question though: resale value. Based on my reading of "Fighting Chance" report, it seems like Mazda5 will hold its value pretty tight, on par with Honda or Toyota, but I am curious what kinds of impacts the "rarity" factor -- I've never seen this car before, kinda response from a potential buyer-- might have on selling Mazda5, say in three or four years. Any general thought? Thanks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

resale value?

- Thread starter ansatzjp

- Start date

Puckpimp71

Member

- :

- 1991 Taurus SHO, 2003 Black Mazdaspeed Protege

The main thing to look at when you're concerned about the resale factor is build quality/ will there be a market for this car/ are there any rebates on the new ones... Just going by the Mazda3 as far as build quality goes, since there's many similarities between the two cars and the Mazda3 holds value better, or as well as any car in its class the Mazda5 has a strong shot of having decent resale value. Mazda has announced the 2007 Mazda5, which is good because there's market for this car and finally, since there's no rebates that will let you get a new for as cheap as a used one, I'm going to venture a guess that these should depreciate on par with the 3. The rarity factor won't get you very far in this case however, since it's not limited edition.

Resale value is really tough at this point with the vehicle so young. Kelly Blue Book and other big information houses don't have any data yet. Still, some research I did looking for used 5's shows pricing to be pretty tight with the MSRP, with variances due mostly to mileage (i.e. a 5 with 20K miles is still priced over $15K). That, along with what else has been said here are very good signs that the vehicle will hold it's value comparable to how well the recent 3's are holding their value.

The real question you need to ask is, "how long to you plan to keep the car?". Ask your self this two ways... first, ask the question regardless of any lease/purchase terms, then again taking your lease/purchase terms into consideration.

Re-sale value should only be considered an important factor if you're leasing or if you plan to sell within 2-4 years. Anything beyond that generally means the car is going into the 2nd tier pre-owned market if you sell, and it's hard to say that far down the road where the 5 will end up. Still, everything so far points to better than average.

The real question you need to ask is, "how long to you plan to keep the car?". Ask your self this two ways... first, ask the question regardless of any lease/purchase terms, then again taking your lease/purchase terms into consideration.

Re-sale value should only be considered an important factor if you're leasing or if you plan to sell within 2-4 years. Anything beyond that generally means the car is going into the 2nd tier pre-owned market if you sell, and it's hard to say that far down the road where the 5 will end up. Still, everything so far points to better than average.

Generally speaking, every car's value will drop 25-50% in the first 3 years... sickening, but true. After that, depreciation slows down... drastically for cars like Toyota and BMW. Mazdas aren't quite as good as those brands, but they're definately not nearly as bad as a domestics either.

While on the subject, any of you get Gap Insurance on your car? I can't decide if it's worth it or not. My agent gave me a rough estimate of $933/yr straight coverage, or $1,003/yr with gap insurance included. For those of you that don't know what it is, it covers you in that time the first few years where you owe more than it's worth so if you total it a year or two after you buy it, you don't owe the lender a couple thousand over what insurance would pay without it.

While on the subject, any of you get Gap Insurance on your car? I can't decide if it's worth it or not. My agent gave me a rough estimate of $933/yr straight coverage, or $1,003/yr with gap insurance included. For those of you that don't know what it is, it covers you in that time the first few years where you owe more than it's worth so if you total it a year or two after you buy it, you don't owe the lender a couple thousand over what insurance would pay without it.

Puckpimp71

Member

- :

- 1991 Taurus SHO, 2003 Black Mazdaspeed Protege

Unless you're putting $5000 down, buy the GAP.

Thanks for the heads up on Mazda financing. I checked into Mazda American Financing and looks like they offer it too --> http://www.mazdacredit.com/buy/buy_financial_prod.html. I can get a 5.74% APR at my local credit union. Quick math shows that I can just get a loan out from Mazda up to about 6.5% APR to balance out the additional cost my my insurance company. I'll have to get back in touch with the dealership to see how the APR is from Mazda... although granted, it'll be 3 months yet until I take my loan out so rates are bound to change.

We didn't get it on my wife's 04 Solara, but then again, she's already caught up to what it's worth (lol)

We didn't get it on my wife's 04 Solara, but then again, she's already caught up to what it's worth (lol)

I agree. If you have a trade-in worth $5000+ or putting down $5,000+, then disregard the gap insurance. The 5000 should be enough equity to cover the initial depreciation. Otherwise, with no trade or down, gap could be a lifesaver if you get in a wreck.Puckpimp71 said:Unless you're putting $5000 down, buy the GAP.

Well, I'm putting $1,000 down and breaking even with my trade, so I def should still get it I suppose. I guess in the end I'll be paying for about 3 year's worth of GAP insurance then I can drop it... $225 all together for protection against thousands. After three years I'll probably owe about $10 grand on it yet, and I think that's probably about what it'll be worth at that point.silverm5 said:I agree. If you have a trade-in worth $5000+ or putting down $5,000+, then disregard the gap insurance. The 5000 should be enough equity to cover the initial depreciation. Otherwise, with no trade or down, gap could be a lifesaver if you get in a wreck.

meackerman

Member

- :

- Mazda 5

My insurance company offers replacement cost for the vehicle for the first year and automatically covers gap insurance. So it varies by insurance company. I didn't buy GAP, didn't need to.

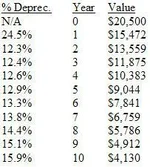

I calculated these values using Edmunds True-Cost-To-Own chart. Values through year 5 are pulled straight from that table, 6-10 are projected based on the pattern of years 0-5. Please also remember, these are USD and I assume it doesnt consider inflation. $20,500 is the figure I received for my 5spd Touring quote with DVD and Sirius. I included the actual numbers as an attachment because this textbox screwed up the tabs.

Attachments

Last edited:

Mind the gap...

I would definately get go for the gap coverage, but price it out first... Here in the US it's usually your insurance carrier that covers this. I can see where the financial institutions would want in on this market too, but before you sign with them I would check with your insurance company first to see what thier cost is...

I would definately get go for the gap coverage, but price it out first... Here in the US it's usually your insurance carrier that covers this. I can see where the financial institutions would want in on this market too, but before you sign with them I would check with your insurance company first to see what thier cost is...

New Posts and Comments

- Replies

- 158

- Views

- 18K

- Replies

- 225

- Views

- 122K

- Replies

- 0

- Views

- 57