You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What have you done to your CX-9 today?

- Thread starter sm1ke

- Start date

What kind of malarkey insurance company will only provide coverage within 15km of home?!? I would start complaining, or at least reading your policy deeper.View attachment 329476View attachment 329476View attachment 329477View attachment 329478

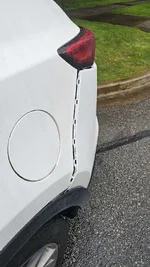

Got rear-ended View attachment 329479

Insurance doesn't want to cover because I am over 15 km from home

Plus, if you were rear-ended, fault would be placed on the other driver...

Agape_365

2019 CX-9 GT AH edition, 2009 Suzuki Swift

Haha welcome to Canada.What kind of malarkey insurance company will only provide coverage within 15km of home?!? I would start complaining, or at least reading your policy deeper.

Plus, if you were rear-ended, fault would be placed on the other driver...

To from work insurance is 15 or 30 km then it jumps from there

It is now also no fault province, so if someone hits you it's now not their fault

- :

- Canada

View attachment 329476View attachment 329476View attachment 329477View attachment 329478

Got rear-ended View attachment 329479

Insurance doesn't want to cover because I am over 15 km from home

Damn, that sucks! I had no idea such a thing existed with regard to insurance. Does the vehicle have some sort of special work/fleet vehicle insurance?

Agape_365

2019 CX-9 GT AH edition, 2009 Suzuki Swift

No this is what a (certain political party gets you)Damn, that sucks! I had no idea such a thing existed with regard to insurance. Does the vehicle have some sort of special work/fleet vehicle insurance?

Agape_365

2019 CX-9 GT AH edition, 2009 Suzuki Swift

Pleasure doesnt matter distance u can choose a two from work distanceWhat province is that? Am i understanding correctly that insurance doesn’t want to cover because you have chosen an insurances policy that only covers a specific distance from home ? I sure hope it is at least very cheap if that is the case.

But ICBC and the (certain party currently in power) constantly changes the rules which retroactively change your policy. New rules means your policy will change without notice.

It's not that cheap, but cheaper then the next step up.

- :

- Mazda CX-9 Signature

No fault even when you rear end someone?!

Agape_365

2019 CX-9 GT AH edition, 2009 Suzuki Swift

no one is “at fault” for an accident, then the negligent driver has no consequences for their bad decisions except for an increase in their premiums. If you are found zero then u don't have to pay your deductible. But icbc always finds fault with everyone,No fault even when you rear end someone?!

No fault insurance means restaurant had to "temporarly close" as owners couldn't afford repairs. But funny how it will still drive up everyone's insurance premiums.

- :

- 2009 Mazda CX-9 GT

ICBC offers a savings if you drive 15km or less, to and from work. So if you were driving farther than that to work, and got in an accident, of course you aren't covered. If you were driving other than to work, then there is coverage.

Agape_365

2019 CX-9 GT AH edition, 2009 Suzuki Swift

14.8 km from driveway to where I was parked according to Google maps taking the exact route I driveICBC offers a savings if you drive 15km or less, to and from work. So if you were driving farther than that to work, and got in an accident, of course you aren't covered. If you were driving other than to work, then there is coverage.

- :

- 2009 Mazda CX-9 GT

Then you are covered.14.8 km from driveway to where I was parked according to Google maps taking the exact route I drive

Agape_365

2019 CX-9 GT AH edition, 2009 Suzuki Swift

That's if the disput goes thru.Then you are covered.

- :

- 2009 Mazda CX-9 GT

Good luck.That's if the disput goes thru.

ICBC offers a savings if you drive 15km or less, to and from work. So if you were driving farther than that to work, and got in an accident, of course you aren't covered. If you were driving other than to work, then there is coverage.

Very interesting. Didn’t realize BC had provincial vehicle damage coverage. Out of curiosity though, why would you ever say that you were driving to work the day of the accident. What kind of verification would they do?

everywhere else the insurance companies also ask how far your work commute is, but i always thought it was just to determine how much you normally drive per work day, which is then linked to the accident risks and premium etc.

Of course if you say work is 15 km away and it turns out it is 50 then they could maybe claim false declaration and deny a claim based on that, but i don’t know if this really happens or not.

Anyway. It is interesting to see how other provinces work. I wish agape the best of luck with his claim. Thankfully the damage doesn’t seem too bad. If the bumpers clips are still good it could probably clip back in place. And the BSM sensor may still be fine as well.

Agape_365

2019 CX-9 GT AH edition, 2009 Suzuki Swift

Because u have to provide location of the accident and they already have your home address, BSM is shot it got crunched, got notification the other driver claimed fault. I still have a request for the maintnance worker to pull camera footage if that area was covered.Very interesting. Didn’t realize BC had provincial vehicle damage coverage. Out of curiosity though, why would you ever say that you were driving to work the day of the accident. What kind of verification would they do?

everywhere else the insurance companies also ask how far your work commute is, but i always thought it was just to determine how much you normally drive per work day, which is then linked to the accident risks and premium etc.

Of course if you say work is 15 km away and it turns out it is 50 then they could maybe claim false declaration and deny a claim based on that, but i don’t know if this really happens or not.

Anyway. It is interesting to see how other provinces work. I wish agape the best of luck with his claim. Thankfully the damage doesn’t seem too bad. If the bumpers clips are still good it could probably clip back in place. And the BSM sensor may still be fine as well.

- :

- 2009 Mazda CX-9 GT

Why would you lie? Pretty easy for them to find out your life schedule.Very interesting. Didn’t realize BC had provincial vehicle damage coverage. Out of curiosity though, why would you ever say that you were driving to work the day of the accident. What kind of verification would they do?

They have discounts for yearly mileage driven as well as the "less than 15km to and from work." If you have the below 15km coverage, you are allowed to drive the vehicle to work, up to 6 times per month. I know of a lot of people that get this coverage, and drive over 15km to work, 5 days a week. Pretty risky to save a few bucks.everywhere else the insurance companies also ask how far your work commute is, but i always thought it was just to determine how much you normally drive per work day, which is then linked to the accident risks and premium etc.

People making false declarations on insurance to save a buck? Yes it happens and happens a lot.Of course if you say work is 15 km away and it turns out it is 50 then they could maybe claim false declaration and deny a claim based on that, but i don’t know if this really happens or not.

New Posts and Comments

- Replies

- 828

- Views

- 478K

New Threads and Articles

-

-

Mazda2 DE 1.5L MZR ZY-VE Engine - Oil Viscosity for High Ambient Temp Operation

- By OZCorolla_x

- Replies: 0