- :

- 2020 CX-5 Signature Azul Metalico

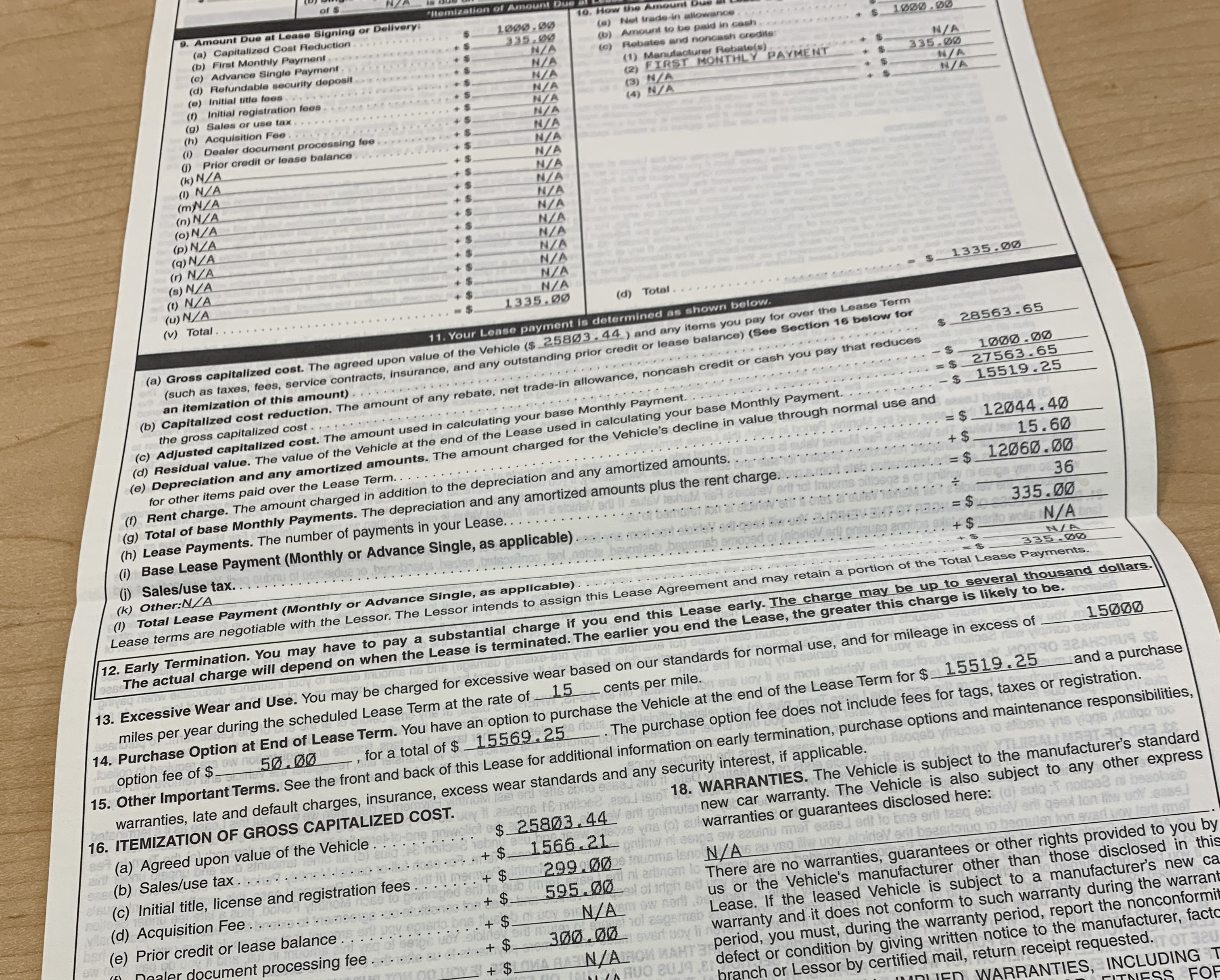

When you buy a CX-5 in the US are all taxes included in the quotation and subsequent sales contract? I know a lot of price negotiation is standard procedure there. Here in Colombia there is essentially no negotiation, The price is the price. This dealer or that might toss in a tiny extra to encourage you to chose them over the others but the vehicle price is the same. Trade in price is also standardized. When purchased my new Signature I was given a written quote with two numbers. One was the cost of the car complete with all taxes and the second was the cost of registration and obligatory government insurance. I paid for the car in cash exactly at the figures on the quote and there were no offers or suggestions of dealer add ons of any kind.